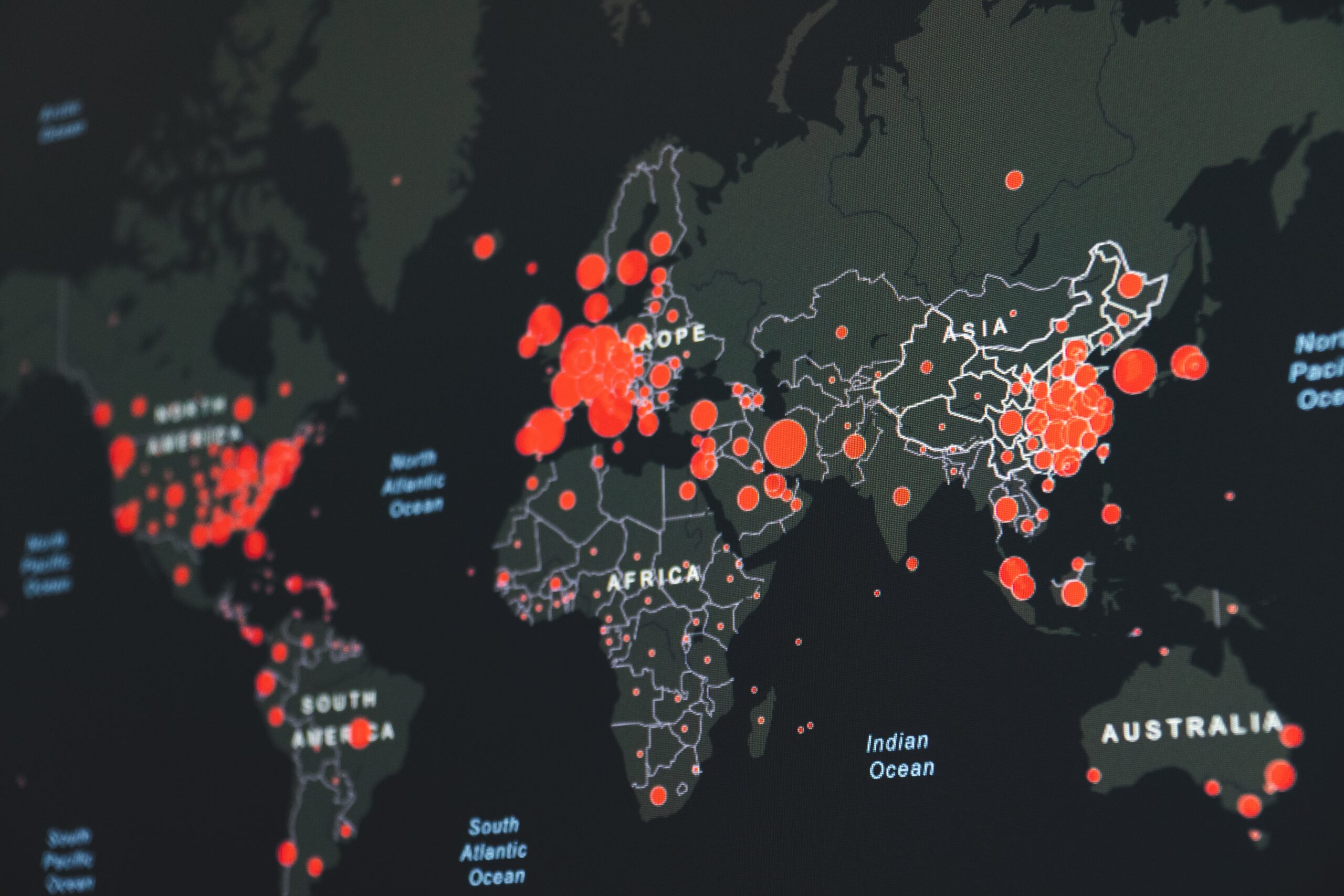

Since early 2020, the COVID-19 Pandemic has sent shockwaves around the world, leading to governments implementing international boarder closures, social distancing measures and self-isolation directions in an attempt to “Stop the Spread”. However, these measures have causing large scale disruptions to society and business.

Although restrictions are beginning to ease in Australia, the impacts of COVID-19 are continuing to be felt by participants of major construction and infrastructure projects. Both Principals and Contractors alike are being impacted with additional risk increasingly being imposed on major construction and infrastructure projects in Australia with each new government measure.

This four-part series will explore:

- The impact of COVID-19 on major projects and construction in Australia, providing an overview of recent public investments and evolving government regulations;

- Challenges for current and ongoing projects and disputes that are likely to arise as a result of COVID-19;

- The emergence of new risks within the construction industry and reflect on the lessons learnt in ensuring the success of future projects; and

- Strategies for mitigating the impacts of COVID-19 and managing long-term risks.

Current Industry Climate

As Australia enters the new year, major construction projects are gearing up to start due to federal and state government spending announced in mid-2021 with hopes of stimulating the economy through job creation. In addition to the Federal Government announcement in May that they would be spending $10 billion over 10-years on major infrastructure projects, State Governments have made substantial infrastructure commitments. These State investments include:

| State | Funding | Key Projects |

| NSW | More than $3 billion | a. $2.03 billion for Great Western Hwy.

b. $400 million for Princes Hwy. c. $240 million for the Mount Ousley Interchange. |

| Vic | $3 billion | a. $2 billion for the Intermodal Terminal in Melbourne.

b. $307 million for the Pakenham Roads Upgrade. c. $203.4 million for the Monash Roads Upgrade. |

| WA | $1.3 billion | a. $379 million for METRONET Upgrades.

b. $200 million for Great Eastern Hwy. c. $160 million for WA Agricultural Supply Chain Improvements. d. $112.5 million for Reid Hwy. e. $85 million for Perth Airport Precinct. f. $64 million for Toodyay Road Upgrade. g. $55 million for Mandurah Estuary Bridge Duplication. |

| SA | $3.2 billion | a. $2.6 billion allocated for the North-South Corridor

b. $161.6 million for the Truro Bypass. c. $148 million for Augusta Highway Duplication Stage 2. |

| Qld | $1.6 billion | a. $400 million for the Inland Freight Route Upgrades.

b. $400 million in additional funding for Bruce Hwy Upgrades. c. $240 million for the Cairns Western Arterial Road Duplication. |

| NT | $323.9 million | a. $150 million for Northern Territory National Network Upgrades. |

| Tas | $322.6 million | a. $80 million for Bass Hwy Safety and Freight Efficiency Upgrades.

b. $48 million for the Algona Rd Interchange & Duplication of the Kingston Bypass. c. $44 million for the Rokeby Rd-South Arm Rd Upgrades. |

| ACT | $167.3 million | a. $26.5 million to duplicate the remaining sections of William Hovell Drive.

b. $2.5 million for upgrades to Beltana Rd. |

Despite the investment commitments from the Federal and State Government, the construction industry is facing considerable barriers due to the continued ripple effect of lockdowns, including, supply chain disruptions, increased risk of cost exceedances, and labour shortages. Nevertheless, the infrastructure and construction sectors, jointly account for approximately 12.2% of the national GDP, and due to the recent public investments, the Australian Construction Industry Forum (ACIF) projections expect the industries to return to pre-COVID levels by 2022-23.

Updated Restrictions

The State Governments have recently revised their definitions of ‘essential workers’ to cast a wider net, and to minimize the ongoing impacts of the pandemic.

New South Wales

In NSW, the use of the COVID-19 Safe Check-In is not required for construction to continue regardless of vaccination status. The government has also published an optional ‘COVID-19 Safety Plan’ to assist businesses in keeping a safe environment for employees.

Victoria

In Victoria, workers in key sectors, including the construction industry, are required to be fully vaccinated to work onsite. Additional industry obligations apply to Melbourne construction sites, which requires wastewater surveillance testing where there are more than 400 works, with all workers in scope for testing. Importantly, it is the employer’s responsibility to ensure workers undergo surveillance testing in accordance with the surveillance testing requirements.

Queensland

In December 2021, the construction industry and its stakeholders in Queensland, in consultation with Queensland Health, released a ‘Queensland Construction and Related Industries COVID Safe Plan’. In addition to face mask requirements, contact tracing, and social distancing measures, the report highlights industry priorities, including:

- Pre-Site Requirements such as proof of vaccination, PCR and Rapid Antigen Testing, and temperature scanning upon entry to work sites.

- Onsite Works Requirements in relation to staggering employee shift schedules and regular cleaning.

- As well as guidance on what steps to take where a positive case arises.

Although the state governments are taking similar approaches in restrictions for the major project and construction industry, due to the evolving nature of responses to the pandemic, we urge industry participants to regularly review their contractual obligations and monitor ongoing changes to regulatory frameworks, laws, and health directives. Participants should consider how to implement strategies that may minimize the risk of disruption, delay, cost exceedances, and labour shortages to facilitate the completion and success of their projects.

Lamont Project & Construction Lawyers

We have the industry knowledge and experience to assist both Principals and Contractors in all major projects, their unique challenges and implementing contractual frameworks which best align with project objectives. If you have any questions about any matters raised in the above article or the forthcoming series as it relates to your specific circumstances, please contact Lamont Project & Construction Lawyers.

The content of this article is for information purposes only; it does not discuss every important topic or matter of law, and it is not to be relied upon as legal advice. Specialist advice should be sought regarding your specific circumstances.

Contact: Peter Lamont or Quinn Hironaka

Email: [email protected] or [email protected]

Phone: (07) 3248 8500

Address: Suite 1, Level 1, 349 Coronation Drive, Milton Qld 4064

Postal Address: PO Box 1133, Milton Qld 4064